Stock Option Basics. Definition: A stock option is a contract between two parties in which the stock option buyer (holder) purchases the right (but not the obligation) to buy/sell shares of an underlying stock at a predetermined price from/to the option seller (writer) within a fixed period of time A stock option contract typically represents shares of the underlying stock, but options may be written on any sort of underlying asset from bonds to currencies to commodities 07/05/ · What is a Stock Option? A stock option is the right granted to an investor, not an obligation, to buy or sell a stock at a specifically agreed upon price and date. Stock options are traded on exchanges similar to the stocks themselves. The price of an option can be lower or higher than the current market price of the stock and blogger.coms: 12

Stock Option Definition

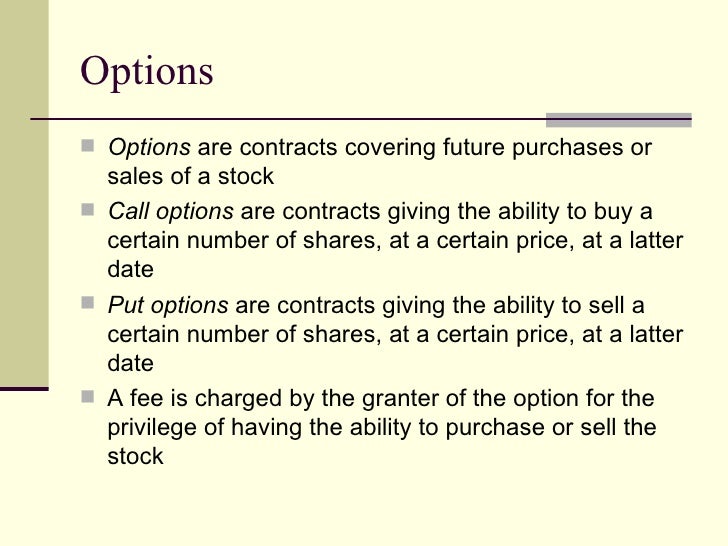

Options trading may seem overwhelming at first, but it's easy to understand if you know a few key points. Investor portfolios are usually constructed with several asset classes. These may be stocks, bonds, ETFs, and even stock market options explained funds. Options are another asset class, and when used correctly, they offer many advantages that trading stocks and ETFs alone cannot. Options are contracts that give the bearer the right—but not the obligation—to either buy or sell an amount of some underlying asset at a predetermined price stock market options explained or before the contract expires.

Like most other asset classes, options can be purchased with brokerage investment accounts. They do this through added income, protection, and even leverage. A popular example would be using options as an effective hedge against a declining stock market to limit downside losses, stock market options explained. Options can also generate recurring income. Additionally, they are often used for speculative purposes, such as wagering on the direction of a stock.

There is no free lunch with stocks and bonds, stock market options explained. Options are no different. Options trading involves certain risks that the investor must be aware of before making a trade. This is why, when trading options with a broker, you usually see a disclaimer similar to the following. Options involve risks and are not suitable for everyone.

Options trading can be speculative in nature and carry a substantial risk of loss. Options belong to the larger group of securities known as derivatives.

A derivative's price is dependent on or derived from the price of something else. Stock market options explained are derivatives of financial securities—their value depends on the price of some other asset.

Examples of derivatives include calls, puts, futures, forwardsswapsand mortgage-backed securities, among others. Options are a type of derivative security. An option is a derivative because its price is intrinsically linked to the price of something else. If you buy an options contractit grants you the right but not the obligation to buy or sell an underlying asset at a set price on or before a certain date. A call option gives the holder stock market options explained right to buy a stock and a put option gives the holder the right to sell a stock.

Think of a call option as a down payment on a future purchase. A potential homeowner sees a new development going up. That person may want the right to purchase a home in the future but will only want to exercise that right after certain developments around the area are built.

The potential homebuyer would benefit from the option of buying or not. Well, they can—you know stock market options explained as a nonrefundable deposit. The potential homebuyer needs to contribute a down payment to lock in that right. With respect to an option, this cost is known as the premium. It is the price of the option contract. This is one year past the expiration of this option. Now the homebuyer must pay the market price because the contract has expired.

Now, think of a put option as an insurance policy. The policy has a face value and gives the insurance holder protection in the event the home is damaged.

What if, instead of a home, your asset was a stock or index investment? There are four things you can do with options:. Buying stock gives you a long position. Buying a call option gives you a potential long position in the underlying stock, stock market options explained.

Short-selling a stock gives you a short position. Selling a naked or uncovered call gives you a potential short position in the underlying stock. Buying a put option gives you a potential short position in the underlying stock market options explained. Selling a naked or unmarried put gives you a potential long position in the underlying stock.

Keeping these four scenarios straight is crucial. People who buy options are called holders and those who sell options are called writers of options. Here is the important distinction between holders and writers:.

Speculation is a wager on future price direction. A speculator might think the price of a stock will go up, perhaps based on fundamental analysis or technical analysis, stock market options explained. A speculator might buy the stock or buy a call option on the stock. Speculating with a call option—instead of buying the stock outright—is attractive to some traders because options provide leverage.

Options were really invented for hedging purposes. Hedging with options is meant stock market options explained reduce risk at a reasonable cost. Here, we can think of using options like an insurance policy. Just as you insure your house or car, options can be used to insure your investments against a downturn, stock market options explained. Imagine that you want to buy technology stocks. But you also want to limit losses.

By using put options, you could limit your downside risk and enjoy all the upside in a cost-effective way. For short sellerscall options can be used to limit losses if the underlying price moves against their trade—especially during a short squeeze.

In terms of valuing option contracts, it is essentially all about determining the probabilities of future price events. The more likely something is to occur, the more expensive an option that profits from that event would be.

For instance, a call value goes up as the stock underlying goes up. This is the key to understanding the relative value of options. The less time there is until expiry, the less value an option will have. This is because the chances of a price move in the underlying stock diminish as we draw closer to expiry, stock market options explained.

This is why an option is a wasting asset. Because time is a component of the price of an option, stock market options explained, a one-month option is going to be less valuable than a three-month option. This is because with more time available, the probability of a price move in your favor increases, and vice versa. Accordingly, the same option strike that expires in a year will cost more than the same strike for one month, stock market options explained. This wasting feature of options is a result of time decay.

Volatility also increases the price of an option. This is because uncertainty pushes the odds of an outcome stock market options explained. If the volatility of the underlying asset increases, larger price swings increase the possibilities of substantial moves both up and down.

Greater price swings will increase the chances of an event occurring. Therefore, the greater the volatility, the greater the price of the option. Options trading and volatility are intrinsically linked to each other in this way. On most U. The majority of the time, holders choose to take their profits by trading out closing out their position.

This means that option holders sell their options in the market, and writers buy their positions back to close. Fluctuations in option prices can be explained by intrinsic value and extrinsic valuewhich is also known as time value, stock market options explained. An option's premium is the combination of its intrinsic value and time value. Intrinsic value is the in-the-money amount of an options contract, which, for a call option, is the amount above the strike price that the stock is trading.

Time value represents the added value an investor has to pay for an option above the intrinsic value. This is the extrinsic value or time value. So, stock market options explained, the price of the option in our stock market options explained can be thought of as the following:.

In real life, options almost always trade at some level above their intrinsic value, because the probability of an event occurring is never absolutely zero, stock market options explained, even if it is highly unlikely. Call options and put options can only function as effective hedges when they limit losses and maximize gains. In such a scenario, your put options expire worthless.

If the price declines as you bet it stock market options explained in your put optionsthen your maximum gains are also capped. Therefore, your gains are not capped and are unlimited. The table below summarizes gains and losses for options buyers. Call options and put options are used in a variety of situations. The table below outlines some use cases for call and put options.

As mentioned earlier, traders use options to speculate and hedge. To maximize their returns, traders track options prices and employ sophisticated strategies, such as a strangle or an iron condor. Here is a quick introduction to some of the strategies that are fairly simple but effective in making money. You can find out more about options strategies here.

Long Call. As the name indicates, going long on a call involves buying call options, betting that the price of the underlying asset will increase with time.

Iron Condor Options Trading Strategy - Best Explanation

, time: 11:46Stock Options Trading Guide and Basic Overview

07/05/ · What is a Stock Option? A stock option is the right granted to an investor, not an obligation, to buy or sell a stock at a specifically agreed upon price and date. Stock options are traded on exchanges similar to the stocks themselves. The price of an option can be lower or higher than the current market price of the stock and blogger.coms: 12 A stock option contract typically represents shares of the underlying stock, but options may be written on any sort of underlying asset from bonds to currencies to commodities 27/04/ · Options trading is the act of buying/selling a stock's option contracts in an attempt to profit from the stock's future price movements. Traders can use options to profit from stock price increases (bullish trades), decreases (bearish trades), or even when a stock's price remains in a specific range over time (neutral trades).Estimated Reading Time: 10 mins

No comments:

Post a Comment