12/08/ · Exercising a stock option means purchasing the shares of stock per the stock option agreement. The benefit of the option to the option holder comes when the grant price is lower than the market value of the stock at the time the option is blogger.comted Reading Time: 9 mins Exercising An Option The basic premise of options are that they are financial contracts that give the holder the right, but not the obligation, to buy or sell an underlying security at a fixed price. Should the holder choose to enforce their right under the terms of the contract, they are said to be exercising their option 03/06/ · Exercising stock options means buying the company’s stock at the grant price fixed by the company under the option agreement. As an employee of the company, you have to follow all the regulations stated in the agreement to exercise your stock blogger.comted Reading Time: 9 mins

Exercise Stock Options: Everything You Need to Know

For many startups, employee incentive packages have become somewhat of a sensitive topic, as companies struggle to find out the right package for their employees, what does stock options exercised mean. When it comes to attracting highly-skilled employees and retaining your existing staffstock options often come up. However, exercising stock options can prove to be a confusing task for new employees, and even for the employers who are offering them, what does stock options exercised mean.

In general, employee benefits are expensive for companies who wish to attract good talent in the field. And these employee benefits can range from a variety of options from traditional salary raisesbonusesextra annual leave or other perks. In order to curb this situation, employee stock options come in. Employee stock options are a part of the employee compensation plan. It occurs when a company grants equity ownership to their executives and employees. Rather, it means that they have given the option to purchase the stock later on instead.

All the details about buying the stocks, and the time period of exercising it will be fully detailed in the employee stock option agreement. And the most significant benefit of stock options are realized when the stock of the company rises above the exercise price.

What is the main reason to offer stock options to employees? Stock options are issued to attract potential new hires and r etain them for a longer period of time, what does stock options exercised mean.

This is just like a way to reward the early employees when and if the company goes public. However, these options are often cancelled when the employee leaves the company before the options are fully vested. This vesting period for the options serves as an incentive for employees to stay with the company.

The right of voting and dividends are not included in the ESOs. After that, you will have equity ownership of the company. If the company grows and becomes successful, the share price will rise and you will be able to purchase the shares at a discount. This will serve as a nice employee benefit for your hard work in the company when you sell the shares later for a profit.

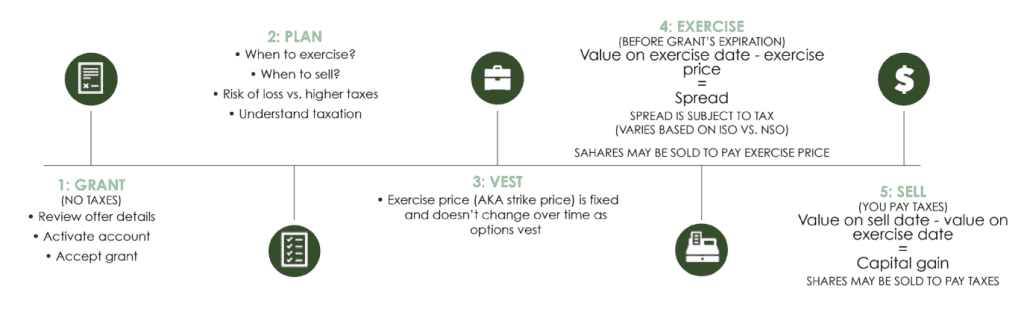

To make sure the performance of the employees is high, and to improve the environment of the workplace, companies grant stock options to employees as a part of their compensation plan. Whenever a company offers stock options to their employees, it means that they are giving the right to buy the shares at a specific price. The price at which you will buy the stocks is also known as the strike priceexercise priceor grant price. Generally, it is the fair market price of the shares at the time you are receiving your options.

People usually sell or exercise the stocks when the grant price is lower than the market value of the stock. At that time, this employee what does stock options exercised mean option is exercised in-the-moneyor at a profit. So now the question arises, when can you exercise your employee stock options? The basic aim to offer stock options is to retain and attract highly-skilled employees for the business, what does stock options exercised mean.

In fact, you may have to keep working for the company for a certain amount of time and complete different milestones before you can exercise the options. The date on which you can earn what does stock options exercised mean right to exercise your stocks is known as the vesting date.

The vesting date is the common feature offered by companies as part of an employee compensation package. So, when you hit your vesting date, you can exercise your stock options as the benefit will be fully owned by you. However, some companies allow workers to experience the benefit of early exercising before the vesting date. So, if your company grants this, you can exercise your stock options, but they will continue to vest according to the original schedule.

Some companies do offer the opportunity for their employees to experience early exercising options. But what exactly does it mean? Early exercise stock options are just like any other stock options granted to consultants, directors, advisors, or employees.

But here, they get the benefit of exercising the stocks before it is fully vested. It has been stated under the option agreement that the option holder remains continuously employed or in service on each vesting date.

This is done at the time when the option holders get the stock option planand it should be reflected in the option agreement. But there are some pros and cons of this early exercising benefit.

An early exercising feature includes both incentive stock options ISOs and nonqualified stock options NSOsbut they work differently. Early exercising could benefit you in a few ways :. Disclaimer: Always remember that you must file an 83 b election within 30 days of exercising to take advantage of this potentially favorable tax treatment. If you miss this deadline, there could be serious ramifications. As an employee of the company, you have to follow all the regulations stated in the agreement to exercise your stock option.

Below we have shared the main four strategies that will help you to exercise your stock options. If you think that the price of the stock will rise over a certain period, then you can take benefit of the long-term nature of the option, what does stock options exercised mean. In fact, you can also wait to exercise them until the market what does stock options exercised mean of the issued stock exceeds the grant price.

But always remember that stock options will expire after a time periodand after that, they will have no value in the market. The second strategy that you can apply while exercising your stock options is the exercise and hold the transaction.

This strategy will give the right for maximum investment in the company stock. In this strategy, you purchase the option shares and then immediately sell enough of the shares just to cover the stock option cost, brokerage commissions, fees, and taxes.

The proceeds you get from an exercise-and-sell-to-cover transaction will be shares of stock. So, you will receive a residual amount in cash. The proceeds you receive from an exercise-and-sell transaction will be equal to the fair market price minus the grant price and the required brokerage commissions, fees and tax withholding. By now, you may have a better idea about exercising employee stock options and how what does stock options exercised mean works for a compan y.

In this way, you can keep all the employees motivated while their interest is centered around the success of the company. If you are setting up a business and are looking to grow it faster, consider using stock options as a viable method for recruiting highly-skilled employees. But in order to keep a track record of everything, you need to have a cap table application that is reliable and easy to use.

And here, Eqvista can help you! Our app is free to try. If you want to start issuing and managing shares, Try out our Eqvista Appit is free and all online! In this article, we take a look at employee stock options ESOs : what they arehow they are exercisedtheir tax implicationsand more. After all, to build up a great team and grow the company successfully, it is essential to have a great employee compensation plan, what does stock options exercised mean.

When the benefits to the employees and startups align, it will reflect on the success of the company. However, you also got the right to do early exercising. So, you can exercise all or a portion of the early exercisable stock option immediatelyeven as to the unvested piece of the award. Also, it offers the potential of gains by increasing the value of the stocks and payment of dividends if any.

You may need to deposit the cash into a brokerage account or borrow on margin to pay for your shares. Moreover, you may be likely to pay brokerage commissions, fees, and taxes. GET STARTED. Categories a Valuation Angel Investors Business Valuation Cap Tables Employee Stock Option FAST Agreement Financial Modeling IPO Issue Shares Venture Capital Firms Vesting.

What does stock options exercised mean posts Top Active Angel Investors List for Startups Google Employee Benefits: Google Stock Units GSUs Best Active Venture Capitalist Firms for Startup Funding.

Stock Options Explained

, time: 10:16Exercising Employee Stock Options (ESO): Guide

Exercise stock option means purchasing the issuer's common stock at the price set by the option, regardless of the stock's price at the time you exercise the blogger.com can do cash or cashless excerise of your stock options 03/06/ · Exercising stock options means buying the company’s stock at the grant price fixed by the company under the option agreement. As an employee of the company, you have to follow all the regulations stated in the agreement to exercise your stock blogger.comted Reading Time: 9 mins 12/08/ · Exercising a stock option means purchasing the shares of stock per the stock option agreement. The benefit of the option to the option holder comes when the grant price is lower than the market value of the stock at the time the option is blogger.comted Reading Time: 9 mins

No comments:

Post a Comment